Picking an ad network isn’t the same as picking a pair of shoes. What works brilliantly for an e-commerce brand selling fashion accessories might be completely wrong for a B2B software company trying to reach enterprise decision-makers. The traffic sources are different, the user behavior is different, and the metrics that matter are different, too.

Most advertisers learn this the hard way. They sign up for a platform that has impressive reach and decent pricing, run a few campaigns, and then wonder why the conversions aren’t there. The problem usually isn’t the budget or even the creative—it’s that they chose a network built for someone else’s business model.

Why Industry Fit Matters More Than Network Size

A massive ad network with billions of impressions sounds great on paper. But here’s what that number doesn’t tell you: where those impressions are coming from and who’s seeing them. An ad network that dominates in gaming apps won’t necessarily deliver quality traffic for financial services. A platform with strong publisher relationships in entertainment media might have almost nothing in the healthcare space.

The targeting options matter just as much. Some networks offer detailed behavioral targeting and intent signals that work well for performance campaigns. Others focus more on contextual placement and brand safety, which matters more for certain industries. When exploring ad networks for advertisers, the key is matching the platform’s strengths with what the specific industry actually needs to succeed.

What E-Commerce Advertisers Should Look For

E-commerce brands need volume, but they also need quality. The best ad networks for online retail have strong relationships with publishers in lifestyle, shopping, and comparison sites, where people are already in a buying mindset. Dynamic retargeting capabilities are basically non-negotiable here—someone who looked at a product but didn’t buy needs to see that product again, not a generic brand ad.

The other thing that separates good from great for e-commerce is mobile optimization. Most shopping traffic comes from mobile devices now, and if an ad network doesn’t have solid mobile inventory with fast-loading formats, conversion rates will suffer. Product feed integration is another feature worth looking for, since it lets advertisers automatically show the right products to the right people without manual campaign updates.

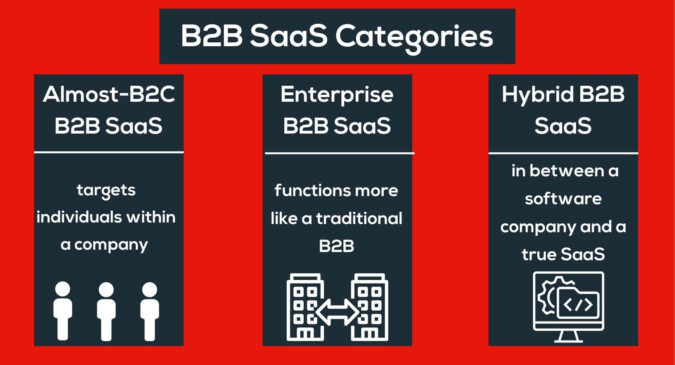

B2B and SaaS Need Different Infrastructure

Business-to-business advertising operates on a completely different timeline than consumer retail. The sales cycle is longer, the audience is smaller and more specific, and a click that doesn’t convert immediately isn’t necessarily a wasted click. This changes everything about how to evaluate an ad network.

B2B advertisers should prioritize networks with professional and business-focused inventory. LinkedIn has dominated this space for good reason, but there are ad networks with strong placements on business news sites, industry publications, and professional content networks that cost significantly less per click. The targeting needs to go beyond demographics—job title, company size, industry, and even technology usage matter here.

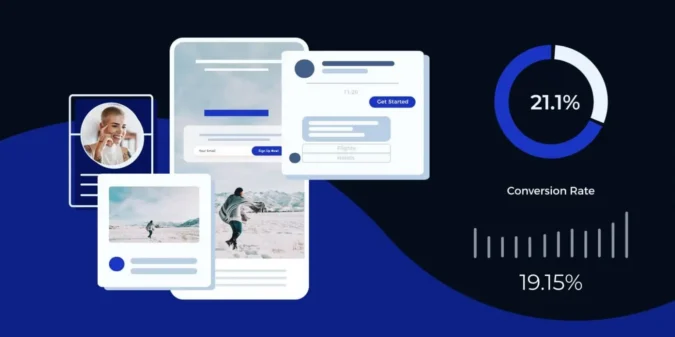

Lead quality tracking is essential, too. A B2B campaign might generate fewer conversions than a consumer campaign, but if those conversions are high-value enterprise leads, the ROI can be substantially better. The ad network needs to support longer attribution windows and offer tracking that goes beyond last-click attribution.

Healthcare and Finance Face Extra Restrictions

Regulated industries can’t just pick any ad network and start running campaigns. Healthcare advertisers need platforms that understand HIPAA considerations and won’t place their ads next to questionable health misinformation. Financial services need networks with strong fraud prevention and brand safety controls, since appearing next to scam content or volatile cryptocurrency discussions can damage credibility.

These industries also benefit from networks that offer more conservative, trustworthy publisher relationships rather than chasing the absolute lowest CPM rates. A slightly higher cost per impression on a reputable health news site is worth more than cheap traffic from content farms that might trigger compliance issues.

The approval process matters too. Some ad networks have specialized teams that understand regulated advertising and can approve compliant campaigns quickly, while others might reject ads that are perfectly fine or approve ones that create problems later.

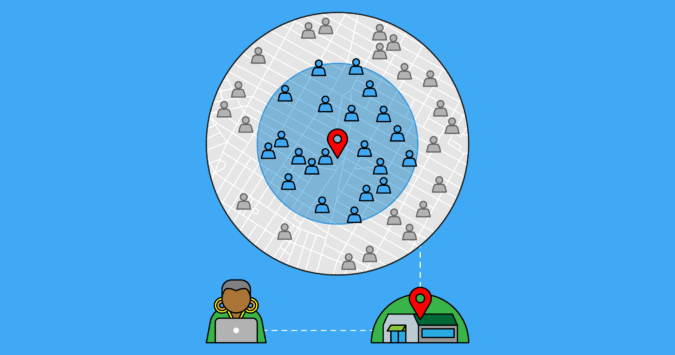

Local and Service-Based Businesses Have Unique Needs

For businesses that serve specific geographic areas—restaurants, home services, local retailers—hyper-local targeting becomes the priority. Not every ad network offers granular location targeting beyond basic city or zip code options. The best ones for local advertisers can target by radius, exclude certain areas, and even adjust bids based on proximity to a physical location.

Mobile is even more critical here than in e-commerce, since people often search for local services while they’re already out and need something immediately. Ad networks with strong mobile app inventory and the ability to target users based on location history tend to perform better for these campaigns.

Testing Without Burning Through Budget

Here’s the thing about finding the right industry fit: it usually requires testing multiple networks. But that doesn’t mean dumping significant budget into five different platforms simultaneously and hoping something works. Start with smaller test budgets on networks that specialize in the relevant industry or have case studies from similar businesses.

Pay attention to more than just cost per click or cost per acquisition during these tests. Look at engagement metrics, time on site after clicking, and bounce rates. Traffic that costs less but immediately bounces is more expensive than traffic that costs more but actually explores the site. Some ad networks deliver traffic that looks great in the dashboard but doesn’t behave anything close to organic visitors.

What Gets Overlooked Too Often

Support quality matters more than most advertisers realize when choosing an ad network. When a campaign isn’t performing or something breaks with tracking, responsive support that understands the industry can save thousands of dollars in wasted spend. A network with self-service tools and zero human support might work fine for experienced advertisers who know exactly what they’re doing, but it’s frustrating for everyone else.

Reporting transparency is another factor that separates professional-grade networks from the rest. Detailed breakdowns of where traffic is coming from, which placements are converting, and what audience segments are responding best give advertisers the information needed to optimize. Networks that only show high-level metrics make it nearly impossible to improve performance over time.

The right ad network match isn’t about finding the biggest or cheapest option. It’s about finding the platform whose traffic sources, targeting capabilities, and infrastructure align with how a specific industry operates and what success actually looks like for that business model. That match makes everything else—from creative strategy to budget allocation—significantly easier to get right.